Input Tax Credit, Ministry of Finance brought changes in the procedure of the order of set-off of the similar order and the said change came into force with effect from 29-03-2019. These new rules were set for minimizing the balance lying under IGST credits so that a balance could be achieved in distribution with the Centre and state. However, if this mechanism of off-setting is not understood and well managed, the businesses could end up with high working capital. It is therefore necessary that the order of utilization of input tax credit is understood, how best it could be optimally utilized and the resultant bearing on the business.

The order of their utilization has been specifically explained through a CGST Circular No. 98/17/2019 issued on 23 April 2019. For instance, it further stated that before the commencement of the Rule 88A of the CGST Rules concerning the preservation of electronic liability on the GST portal, the taxpayers were required to follow the only facility available on the GST portal up to July 2019. The facility was enabled for computation in respect of returns filed after July 2019.

√ “Section 49A: Despite anything contained in section 49, the input tax credit in respect of the central tax, the State tax or the Union territory tax shall be adjusted against the integrated tax, the central tax, the State tax or the Union territory tax as the case maybe, only after the input tax credit available on account of integrated tax has been fully utilized for such adjustment.

√Section 49B: Provided, however, that nothing contained in this Chapter shall take effect unless the order and manner of utilizing input tax credit under integrated tax, central tax, a State or a Union territory tax, as the case may be towards the payment of any such tax, is prescribed by the Government on the recommendations of the Council under clause (e) and clause (f) of sub-section (5) of section 49.

Later on, the above new provision has been added under rule 88A in the CT notification no. 16/2019 dated 29-03-2019.

√Rule 88A: Sequence of utilizing input tax credit: – The input tax credit on integrated tax has to be applied to the integrated tax payable and the balance if any, can be used to discharge central tax, and or State tax or Union territory tax as the case may be without any priority. Subject to the condition that the input tax credit on account of central tax, State tax or Union territory tax shall be admissible only when the input tax credit available on account of integrated tax has been fully adjusted against the payment of integrated tax and the amount of central tax, State tax or Union territory tax, as the case may be.

Let’s understand the impact of New Rule with the help of an illustration:

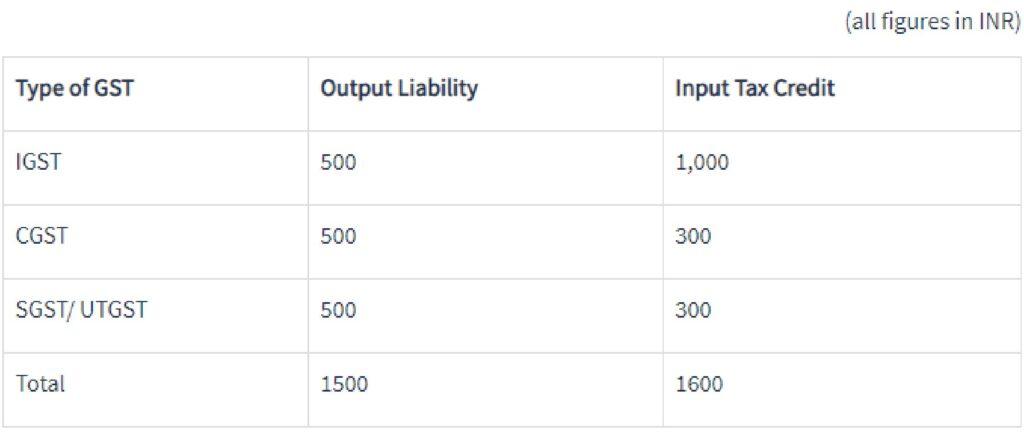

Assume that Mr. X liable for the following: and the input tax credit amount for the period is as follows:

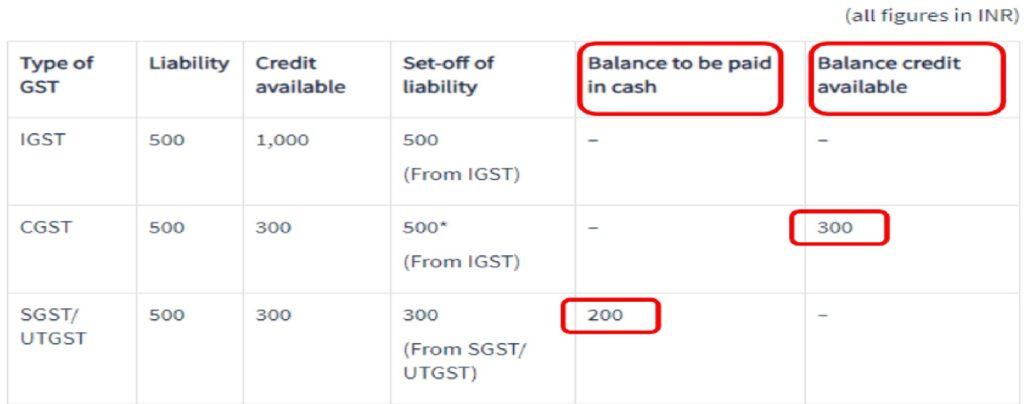

Firstly: Set-off of unutilised IGST credit completely towards CGST

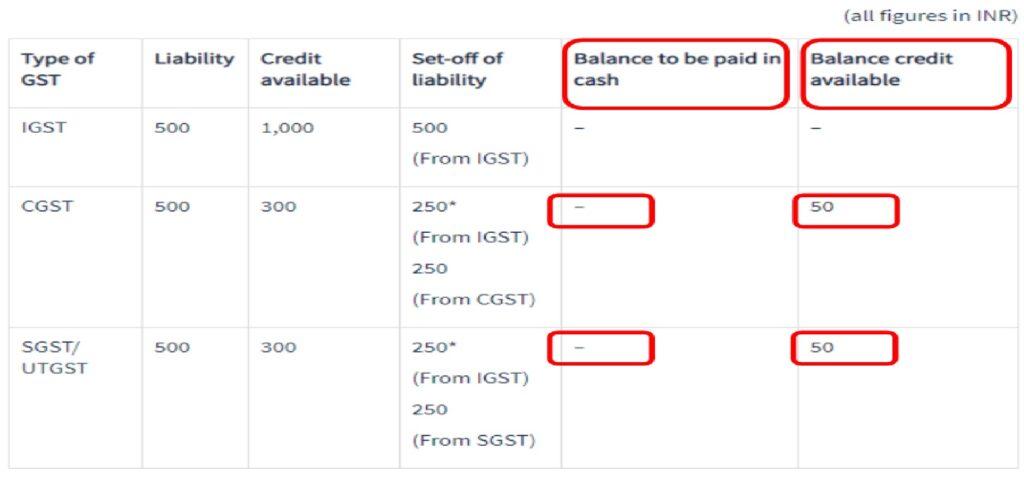

Secondly: Set-off of unutilised IGST credit partly towards CGST and SGST liability

Specific types of taxpayers are restricted from using the balance ITC from the electronic credit ledger to pay more than 99% of the tax liability for a tax period from 1st January 2021. This is where it is required that at totality of 1% of the tax liability be made by cash.

It applies to such taxpayers who have a monthly value of taxable supplies exceeding Rs. 50 lakhs (other than exempt or zero rated supplies).

A registered taxpayer where more than One Lac Rupees is paid as income tax in the last two FY in the case of the belated IT returns of himself or his proprietor or any Two Partners or Managing Director, trustee, or Board, etc.

Any person registered as a taxpayer, who has availed the credit of tax paid on supplies of goods or services, upto an amount not exceeding Rs. 100,000/- as refundable credit for the utilization of input tax credit under the Goods & Services Tax (GST) law due to making of zero-rated supplies of goods and/or services without tax charged thereon or having an inverted tax structure.

The obtained result shows that the registered taxpayer violated the descriptions by using only the electronic cash ledger to pay more than 1% of his GST liability of all the tax periods in the current FY so far.

The target market comprises government departments, PSU, local authorities, statutory bodies, and other related organizations.

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990777 or info@semantictaxgen.in.

© 2013-25 Semantic Taxgen Pvt Ltd - All Rights Reserved