The Income Tax Department breaks down income into five heads of income for the purpose of income tax reporting:

Income from Other Sources means income other than income from employment, business or profession, it can be rental income, interest income, etc. It is income which does not fall under any of the other specified heads of income and may include interest earned on saving bank account, fixed deposits, dividend, rent received, gifts received etc.

Due to the numerous forms of income included under this head, it sometimes causes difficulties for the taxpayers. This guide provided you all the information about other sources of income so that you can easily do your income tax e-filing. In this head the different types of incomes are explained that come under this head how they are calculated how the report is prepared and how to report it while filing for ITR.

As stated under section 56 (1) of the IT Act, 1961, other sources may be defined as all the income received by you from all other sources. In simple words, it is a provision that enables any income that cannot be declared under any other heads of income. it will be classified under this title. Other income is a category of income which covers all sources of income other than the regular business, stock exchange transactions, salaries received by the employee, House Property income, income from business or profession, and Capital gains.

Some common examples of income from other sources are:Some common examples of income from other sources are:

For saving accounts, section 80TTA of the Income Tax Act allows the customers to adjust the deduction on the interest income earned by them.

The availment of deduction under section 80TTA is with regard to the interest earned on savings account maintained with a bank, co-operative society or post office. There is also a limit up to which each of these expenses has to be claimed in a financial year, and this amount is Rs. 10,000 under this section.

Nevertheless, if the interest earned on the savings account exceeds Rs. 10,000/- in a financial year, then the interest will be taxed under the head ‘Income from Other Sources’. It must be noted here that this deduction is not allowable on interest earned on FDs, RDs or any other deposits.

Wish to know about other tax saving deductions that are available to you? Just contact our tax specialists and leave your taxes to us.

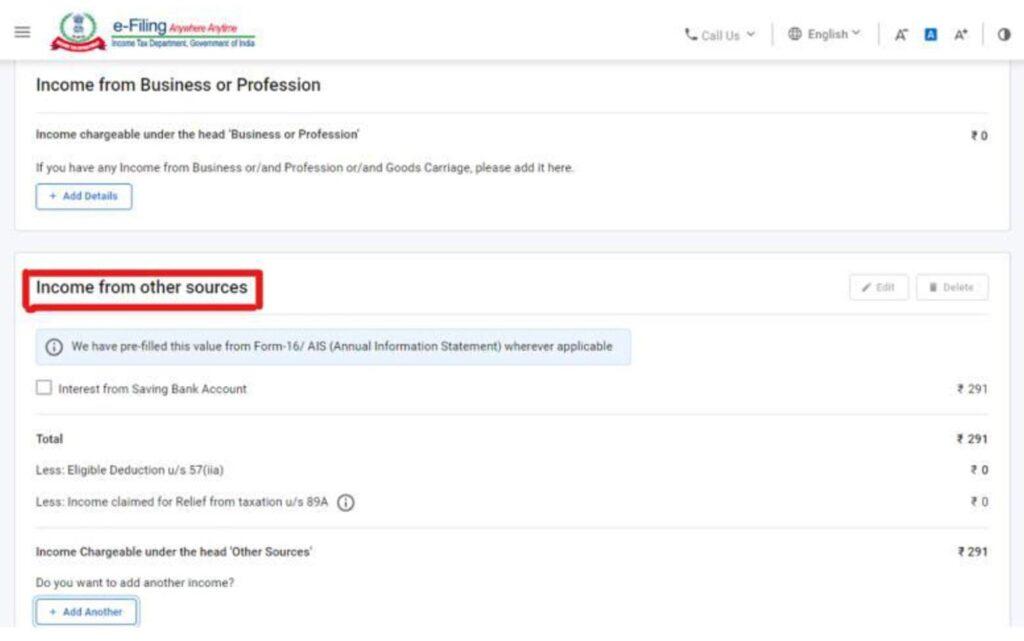

When e filing ITR 1 online, you are required to indicate all other incomes in the total figure from other sources. As shown in the screenshot below, this disclosure has to be made under the tab “Computation of Income & Tax” in the field “B3: The next form that must be filled is. ”Income from Other Sources (Ensure to Fill Sch TDS2)”.

Income from other sources are some gains derived from other activities and sources of income that is computed and added to the taxpayers total gross income, to be then deducted the allowable expenses to arrive at the net earnings for the Income from Other Sources section of the return.

The net earnings under the head ‘Income from Other Sources’ in income tax are calculated as follows:

Total income received from other sources- deductions allowable as per section 57: Income from other sources.

Any income that does not recognized as salary, house property income, business or professional income, or capital gains income is known as income from other sources. Here are some examples of income that are categorized under “Income from Other Sources”:Here are some examples of income that are categorized under “Income from Other Sources”:

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990777 or info@semantictaxgen.in the appropriate government authority to verify the accuracy of the information and to obtain advice on their specific tax situations.

© 2013-24 Semantic Taxgen Pvt Ltd - All Rights Reserved