Due to the steady growth of its economy and population, India is one of the highest remittance making countries in the world. The financial regulator of India, the Reserve Bank regulates as and when one sends money from abroad to India.

Commonly, there are two ways to receive money from outside India. The first one is the Rupee Drawing Arrangement (RDA) and the second one is the Money Transfer Service Scheme.

There are no restrictions on individual access, but there are restrictions on businesses. There is, however, a restriction of 30 transactions per financial year for a single recipient. Individuals must create an NRE (Non-Resident External) account to receive remittances from abroad. This type of money is tax-free.

NRI remittances are transfers of money from overseas to India through permitted providers accepted by the Reserve bank of India. Such transfers are called “inward foreign remittances” or “inward remittances.”

A Foreign Inward Remittance certificate (FIRC) is needed for the recipients and the same can be obtained from the recipient’s bank. It contains information such as sender and recipient names and account numbers, the purpose of the switch, exchange prices, and other info.

In India, inward overseas remittances may be acquired through the Rupee Drawing arrangement (RDA) or money switch provider Scheme (MTSS) accredited by way of the RBI through authorised dealer banks. The RDA scheme allows limitless personal inward remittances to India, even as commercial remittances have a higher cap of Rs. 15 lakhs.

In India, the MTSS scheme imposes a cap on the quantity of inward remittance. Each individual’s inward remittance is limited to a maximum of USD 2500. A beneficiary is allowed to obtain no greater than 30 MTSS transfers per year.

To receive inward remittances in India, one ought to first establish an NRE account. This form of account, called a Non-Resident External Account, is specially designed for moving overseas income to India.

Moreover, it’s no longer allowed to ship money for purposes which include making donations, undertaking industrial activities, making an investment, purchasing assets, or shifting budget to a non-resident outside (NRE) account.

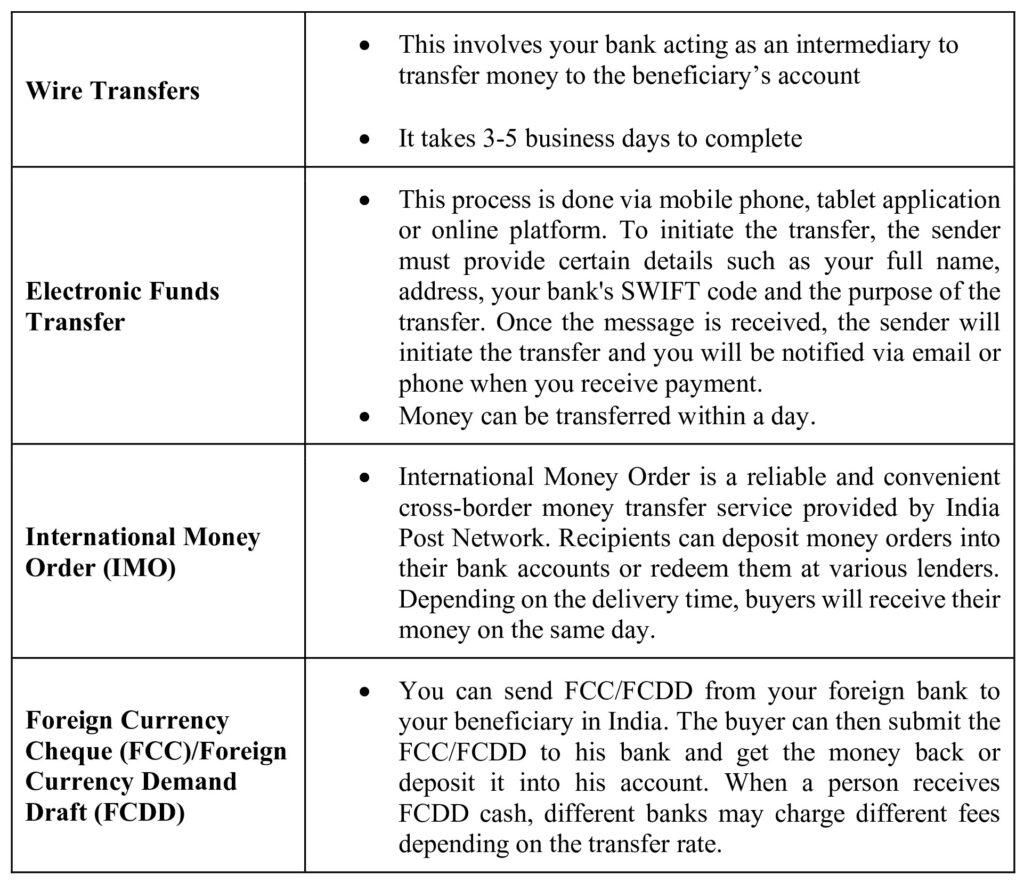

We can conduct inward foreign remittance in India through different modes, like wire transfers and electronic transfers.

Additionally, beneficiaries receiving domestic remittances must obtain a Foreign Inland Remittance Certificate (FIRC) from the beneficiary bank or for doing foreign exchange business in India. It serves as proof of receipt and helps identify the purpose of internal remittances, including the sender’s name and address, while filing the Income Statement (ITR) in India. Banks will issue FIRC only on the request of the beneficiary and the sender bank will issue a No Objection Certificate (NOC).

The remitter must provide the following details to their overseas bank or the authorised service provider for an inward remittance,

√Remitter’s name and address;

√Beneficiary’s name;

√Beneficiary’s bank account details, including the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code;

√Purpose and amount of remittance

After receiving the funds in India, the authorized dealer (bank) converts them into Indian rupees at the exchange rate and internally deposits or transfers the remittance to the recipient in banking in India.

NRIs/PIOs/OCIs (including foreign nationals) can send money to India through various services like online money transfer, bank transfer, and cross-border UPI, IMO and FCC /FCDD. You should choose the option that best suits your needs based on speed, cost and convenience.

In the recent times, the popular Unified Payments Interface or UPI has been marking its presence in the foreign countries. UPI has been dominating online payment transfers in India and the same can be witnesses through astounding transaction numbers each quarter. Owing to its simplicity and security of the payment transfers, it has also significantly increased its presence in foreign countries and cross border receipts directly to India is a very much reality in today’s times.

The Rupee Withdrawal Arrangement (RDA) is a tool for receiving money across borders from foreign jurisdictions. Under this arrangement, Tier 1 banks are allowed to partner with non-resident businesses in FATF-compliant countries to open and maintain Vostro account.

These are companies and financial institutions which they have licenced and are regulated by the competent authority in the sending country for sourcing the funds from the remitters.

Business-related transactions are limited to Rs 15 million.

No cash disbursement is allowed under RDA the remittances must be deposited into the buyer’s bank account.

It can be deposited directly to the beneficiary’s bank account in non-AD type banks such as RDA, NEFT, IMPS etc.

Money Transfer Service Scheme (MTSS) is a method of sending remittances from abroad to beneficiaries in India. Only personal remittances, such as home remittances and remittances to foreign tourists visiting India, are allowed in India.

A cap of USD 2,500 has been placed on individual remittances under the scheme additionally, according to the law, 30 refunds can be received to the rightful owner within one year.

Amounts up to INR 50,000/- may be paid in cash to a beneficiary in India. These can also be placed on bank-issued prepaid cards. Amounts exceeding this limit can be transferred to cheque/time deposit/cash etc. must be paid by other methods. It is paid into the account or deposited directly into the beneficiary’s bank account.

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990777 or info@semantictaxgen.in the appropriate government authority to verify the accuracy of the information and to obtain advice on their specific tax situations.

© 2013-24 Semantic Taxgen Pvt Ltd - All Rights Reserved