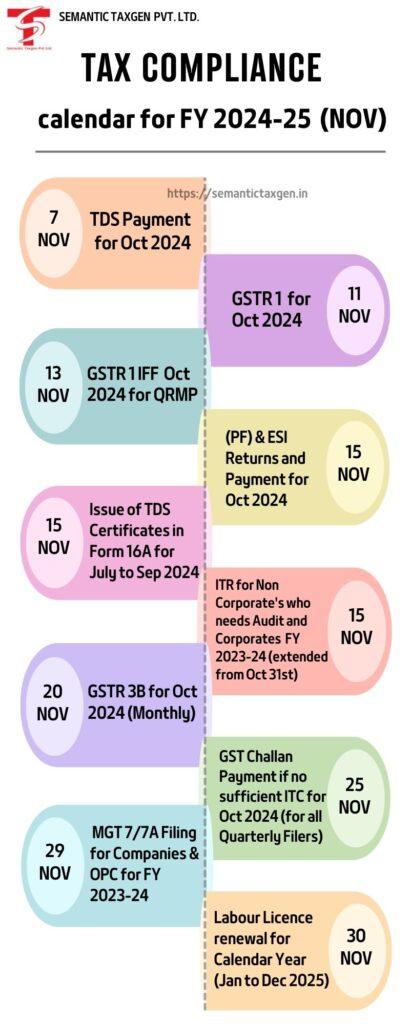

Considering the fact that tax compliance affects all businesses regardless of the size, it is very important for any business to stay up to date to avoid cases of penalties, ensure smooth operations and to achieve credibility. Below are the due date chart for November 2024’s tax compliance for the FY 2024-25 for GSTR and TDS and Income Tax returns.

Making GSTR filings is used to document GST responsibilities effectively. filings ensure proper documentation of GST liabilities. Here are the major due dates for November 2024:

Due Date: 11th November 2024

Description: For entities that use monthly filing of GSTR-1 return, this is the deadline to report the outward supplies and keep correct GST records.

Due Date: 13th November 2024

Description: The taxpayers under QRMP scheme can take the Invoice Furnishing Facility (IFF) for early reporting of the invoices of October to enhance the customer’s cash flow.

Due Date: 20th November 2024

Description: October GSTR-3B should be filed early in the month for the declaration of tax returns and input tax credit availed by the business.

Due Date: 22nd or 24th November 2024

Description: For the taxpayers under the QRMP scheme, GSTR-3B for Q2 has to be filed based on the state selected and is either November 22 for the group A states or November 24 for the group B states.

Timely TDS payments help in preventing interest charges or penalties.

Due Date: 7th November 2024

Description: The TDS for October must be deposited by this date to avoid late fees and interest.

Due Date: 31st October 2024

Description: Ensure submission of the TDS quarterly statement by this date to maintain smooth tax compliance.

Due Date: 15th November 2024

Description: This applies to taxpayers liable for advance tax payments to prevent interest penalties under sections 234B and 234C.

Due Date: 15th November 2024

Description: Monthly remittance of employee provident fund, pension, and ESI contributions for October.

Compliance if done in the right time reduces on penalties and interest on taxes and ensures the free flow of bad blood between you and the tax authorities. Remind your mind or seek advice from a tax advocate so you can remember when it is time to file taxes in November 2024.

To avoid getting penalized and losing out on our tax benefits, paying attention to these due dates help businesses in general financial management.

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990777 or info@semantictaxgen.in

© 2013-25 Semantic Taxgen Pvt Ltd - All Rights Reserved