When we make a company, then the board of directors of the company has to make decisions at board meetings. All decisions taken by the board of directors have an effect on company growth, their employment and their wealth. The board of directors passes board resolutions to make any significant decisions binding. The board of directors of a company shall be entitled to exercise all such powers and to do all such acts and things, as the company is authorized to do and the board cannot exercise any power which is required under memorandum or article for shareholders in a general meeting.

As per section 114(1) of the companies Act, 2013

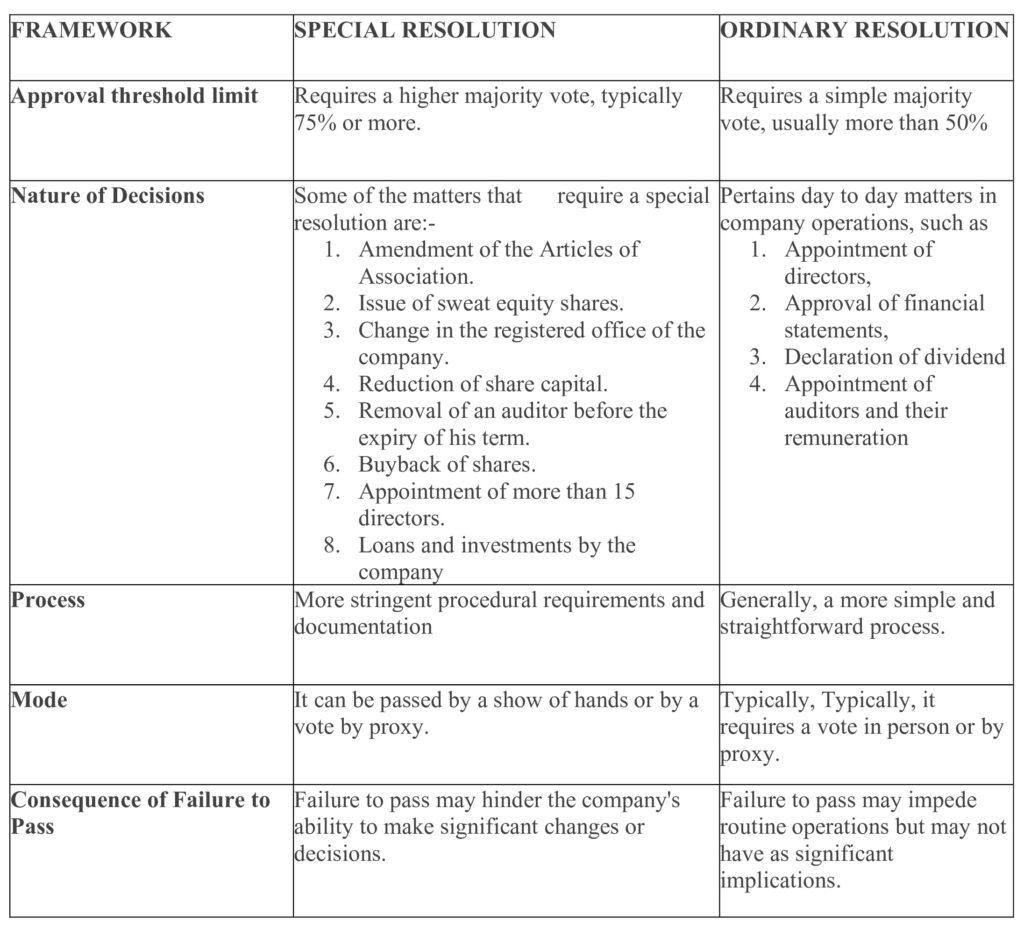

A resolution shall be an ordinary resolution if the notice required under this Act has been duly given, and it is required to be passed by the votes cast, whether on a show of hands, or electronically or on a poll, as the case may be, in favor of the resolution, including the casting vote, if any, of the Chairman, by members who, being entitled so to do, vote in person, or where proxies are allowed, by proxy or by postal ballot, exceed the votes, if any, cast against the resolution by members, so entitled and voting. In simple words, these resolutions need a specific majority percentage and need to be considered valid, like ordinary resolutions require a 51% majority.

As per section 114(2) of the companies Act, 2013

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990777 or info@semantictaxgen.in the appropriate government authority to verify the accuracy of the information and to obtain advice on their specific tax situations.

© 2013-24 Semantic Taxgen Pvt Ltd - All Rights Reserved