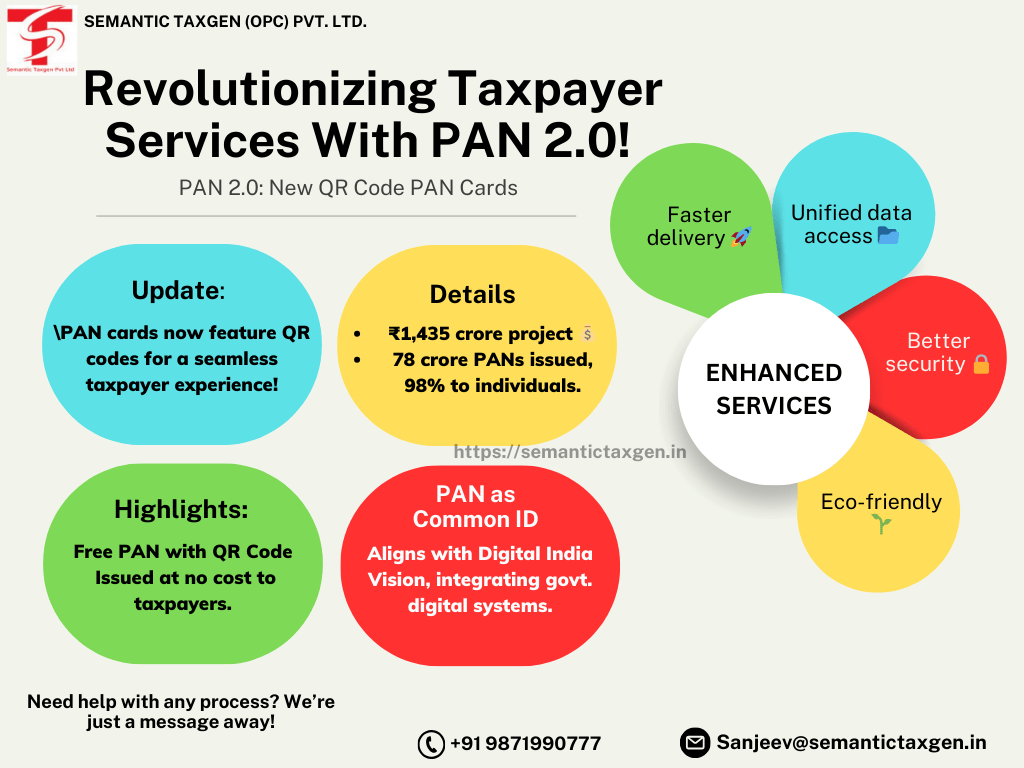

The Permanent Account Number (PAN) card is a ten-digit alphanumeric number, issued in the form of a laminated card, It is a crucial document for taxpayers in India, serving as a unique identifier for financial and tax-related transactions. The Income Tax Department has recently announced an update to the PAN card format. A new version of the PAN card, featuring an embedded QR code, will soon be issued to taxpayers. Here’s everything you need to know about this update, including charges and benefits.

The updated PAN card 2.0 will include a QR code that carries essential information about the cardholder. This QR code will store data such as the individual’s name, date of birth, and PAN number. It will allow for easy and quick verification of details, ensuring accuracy and minimizing fraud risks.

The QR code is designed to provide a tech-savvy solution for identity verification, enabling authorities and financial institutions to authenticate PAN cardholders with just a scan.

The initiative to include QR codes on PAN cards is part of the government’s ongoing efforts to modernize documentation and improve transparency in financial transactions. By adopting digital solutions, the Income Tax Department aims to streamline processes, reduce paperwork, and enhance the overall efficiency of tax administration.

If you’re looking to update or reprint your PAN card with the new QR code, here’s how you can do it:

The introduction of the new QR code-enabled PAN card is a significant step toward digital transformation in India’s financial ecosystem. Taxpayers are encouraged to upgrade to the latest version to enjoy the added benefits of security and convenience.

Stay updated with the latest government initiatives to make the most of modernized services and ensure compliance with the latest regulations.

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990777 or info@semantictaxgen.in

© 2013-25 Semantic Taxgen Pvt Ltd - All Rights Reserved