Get Your Propeitorship Company Registration

• Experienced Professionals

• Comprehensive Solutions

• Quick and Seamless Process

• Affordable and Transparent Pricing

Get Your Expert Consultation

MSME Certificate

GST Certificate

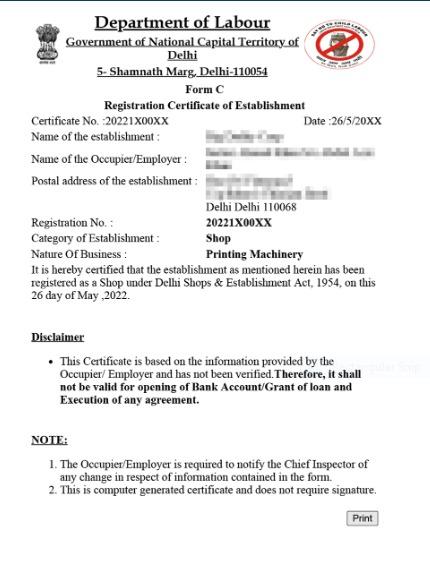

Shop License

How To Register A Propeitorship Company

Step 1

Simply fill the above form to get started.

Step 2

We will connect with you & prepare documents.

Step 3

Get your Company Incorporation Certificate

About Propeitorship Company

An OPC is the newest form of business in India introduced for the first time by the Companies Act, 2013. Only one person is needed to start a company. However, a nominee needs to be nominated. To start an OPC you should check below sections describing eligibility requirements and detailed stepwise procedure.

The OPC is suitable for small businesses where the turnover is not likely to cross Rs. 2 Crores and the maximum amount of capital to be invested is limited to Rs. 50 Lac. An OPC can have more than one director. However one of them must be an Indian Resident. The main limitation of OPC form of company is that only an Indian Citizen can open an OPC Company and FDI is not allowed in one person company.

-

A sole Proprietorship is cheaper as compared to OPC.

-

A proprietorship with income of less than Rs. 2 Lakhs per annum is not required to pay income tax.

-

Easy to establish with less formalities.

Only One Person Required

An OPC can be registered in India, by only one person, who shall act as the directors/shareholders of the company. The maximum number of directors of an OPC is 15 and the number of shareholder cannot go beyond one.

Resident Director

One director of the company must be resident in India. A person is said to be resident if he or she stays in India for at least 182 days during the preceding financial year irrespective of their citizenship. The days of stay can be in phases.

Capital Requirement

Invest as per requirement of your business, and there is no minimum capital requirement as such to be maintained in the company. However, the government fee on company registration is calculated on the capital

Unique Name of Company

The proposed name of the company should not resemble any existing company or LLP. Further you must check the trademark registry to ensure that the name does not match with any registered or applied trademark in India.

Basic Documents to Start a Sole Proprietorship

- Proof of Registered Address

- It should not be older than 2 months

- NOC from the Owner of Premises

- Canceled Cheque of Proprietor

Self Attested Documents of the Sole Proprietor

- Two Photograph

- Copy of PAN Card

- Valid Identity Proof

- Latest Address Proof

How Can We Help In Registering

- Bank Account Opening Document Support

- Incorporation Certificate

- Company PAN Card

- Company Name Approval

Frequently Asked Questions

Who Can Be a Proprietor?

The Proprietor must be an Indian citizen and a Resident of India.

Will Proprietorship firms have a Certificate of Incorporation.

How much money do i need to invest upfront in starting the business?

There is no limit on the minimum capital for starting a Proprietorship. Therefore, a Proprietorship can be started with any amount of minimum capital.

Phone Support

+91 9654831210

Email Support

info@semantictaxgen.in

Visit Us On

501,Rishabh corporate Tower

Kakardooma Community Centre,

New Delhi-110092