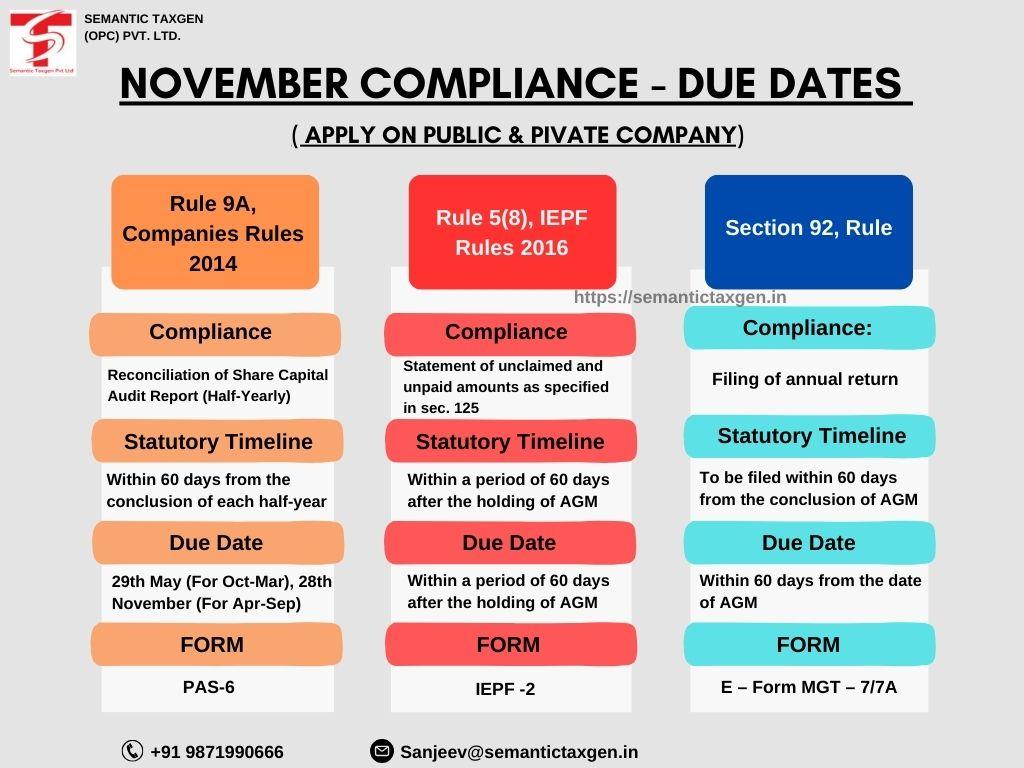

November marks an important month for companies to ensure compliance with various statutory requirements. These apply equally to private and public companies under different rules and regulations. Below is an outline of the critical compliances, their legal basis, and deadlines.

Applicable to: Unlisted public companies and Private companies (Excluding small company)

Requirement:

Unlisted public companies must ensure their securities are dematerialized. They should file Form PAS-6 (Reconciliation of Share Capital Audit Report) for the half-year ending 30th, September 2024 so the due date is 28th, November 2024.

Penalty for Non-compliance:

Failure to comply can attract penalties under Section 450 of the Companies Act, 2013.

Applicable to: All companies (excluding those specifically exempt)

Requirement:

Any amount of unclaimed or unpaid dividends for more than seven years must be transferred to the Investor Education and Protection Fund (IEPF). A detailed statement in Form IEPF-1 should be filed by 30th November 2024.

Implications:

This ensures investors can claim their dividends through IEPF in case they missed them earlier.

Applicable to: All companies

Requirement:

The annual return in Form MGT-7 (for public and private companies) and Form MGT-7A (for small and one-person companies) must be filed within 60 days from the Annual General Meeting (AGM). For companies whose financial year ended on March 31, 2024, the deadline is November 29, 2024 (if AGM was held on September 30).

Compliance not only ensures statutory adherence but also builds credibility and transparency with stakeholders. Stay ahead by marking your calendars and preparing for timely submissions.

Need Help?

Contact us at Semantic Taxgen (OPC) Pvt. Ltd. for expert assistance in managing your company’s statutory compliances efficiently.

© 2013-25 Semantic Taxgen Pvt Ltd - All Rights Reserved