If you have filed your ‘income tax returns’ and expecting the refund for the financial year: 2023-24 with the assessment year: 2024-25, there are several ways to track your refund online. Here is how you can do it through the Income Tax Portal, NSDL Portal and the TRACES.

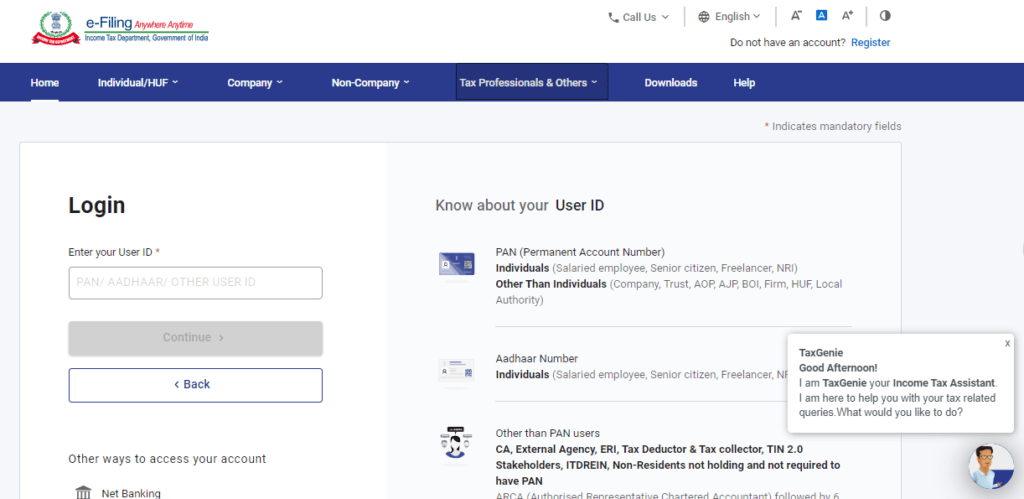

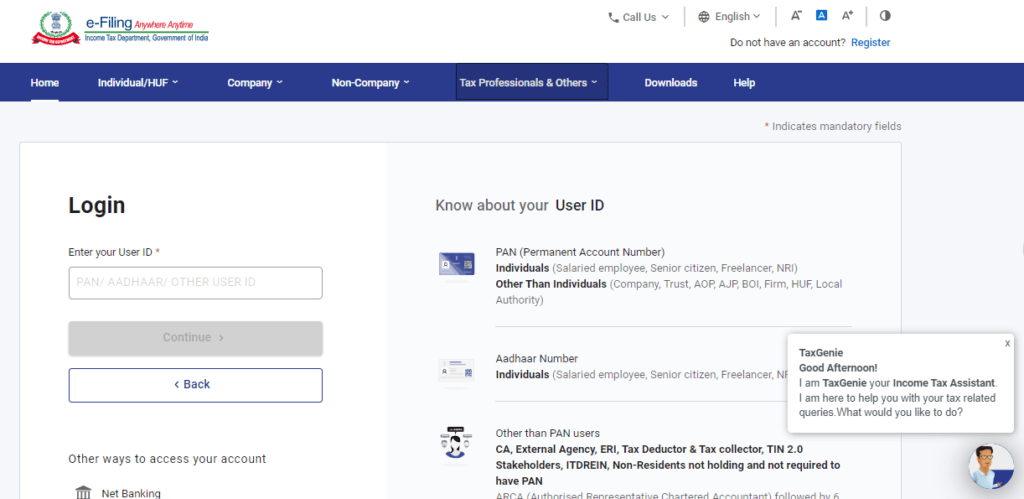

Step- 1: Visit the Income Tax e-Filing Portal:

Go to: www.incometax.gov.in

Step- 2: Log in: Provide your User Id which is your PAN number, password, and captcha code.

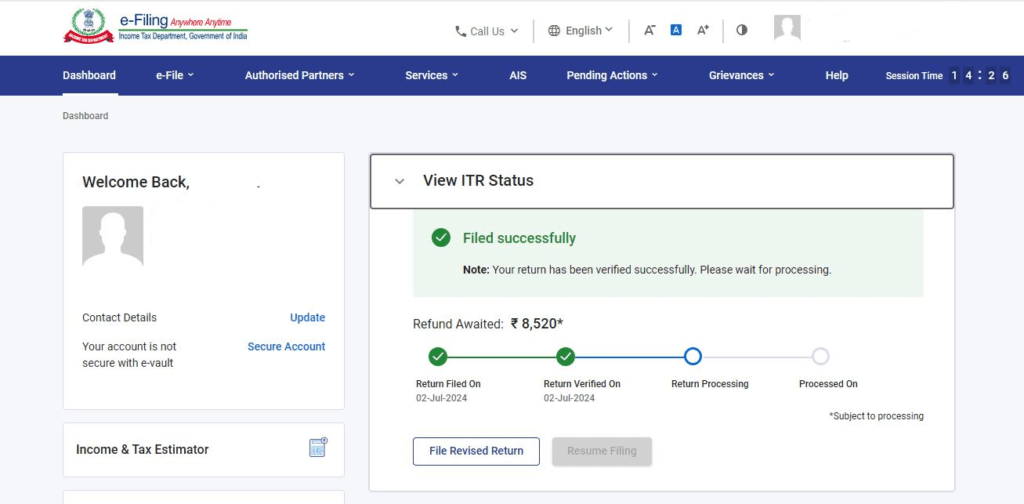

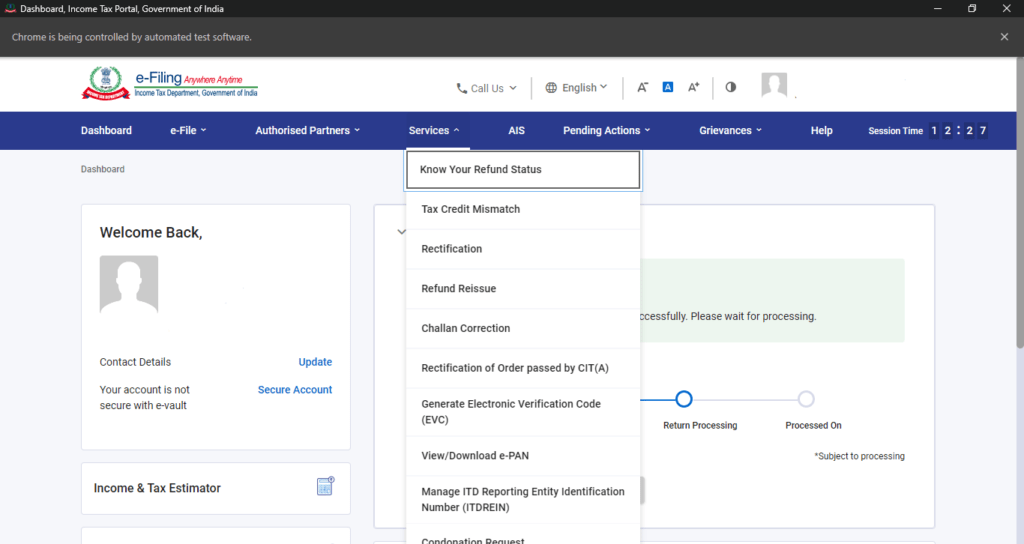

Step 3: After login do click on services button on website and navigate the know your refund status button.

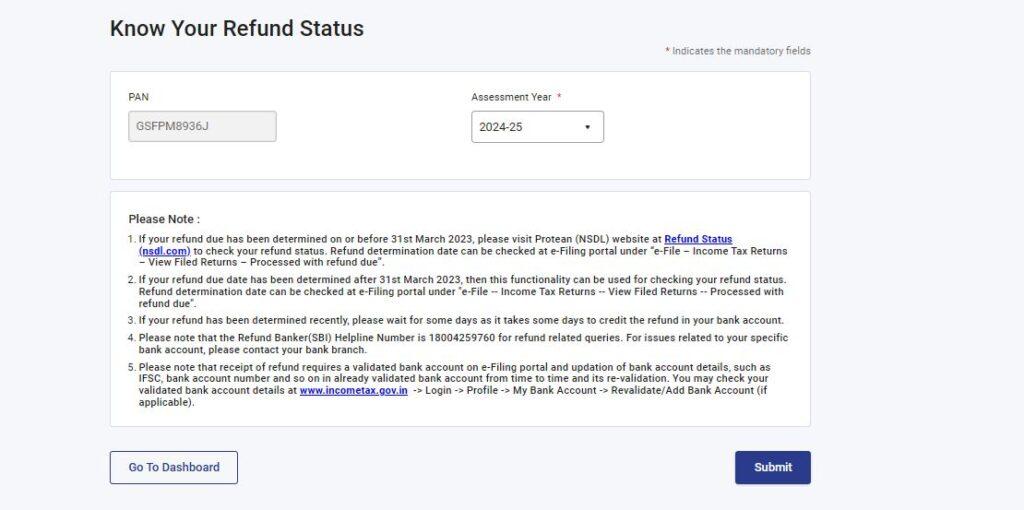

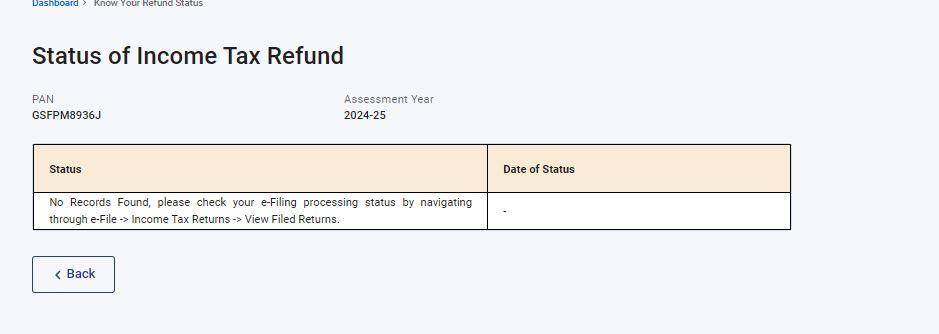

Step 4: After click, know your income tax refund status manual will be shown, Fill your PAN number and assessment year and do click on submit.

Step 5: At last income tax refund status will be shown

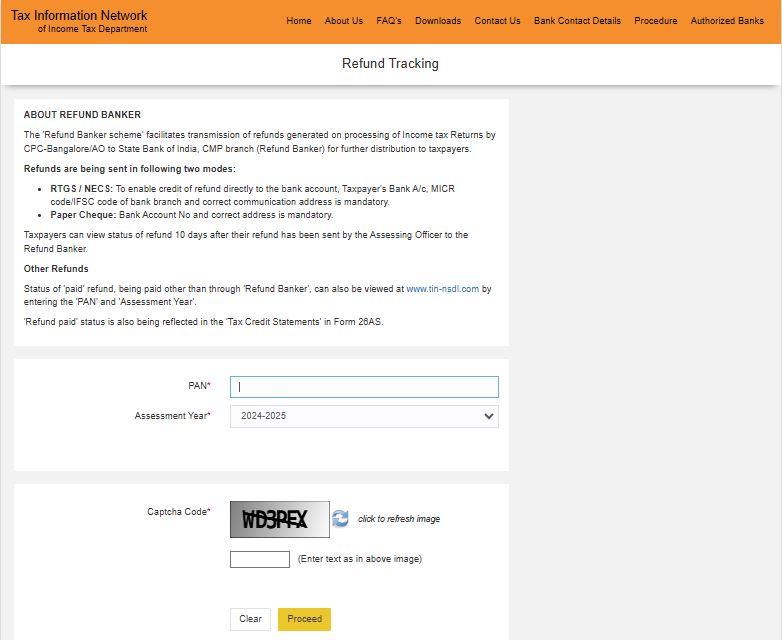

Step- 1: Visit the NSDL TIN Website:

Go to tin: https://tin.tin.nsdl.com/oltas/refund-status-pan.html

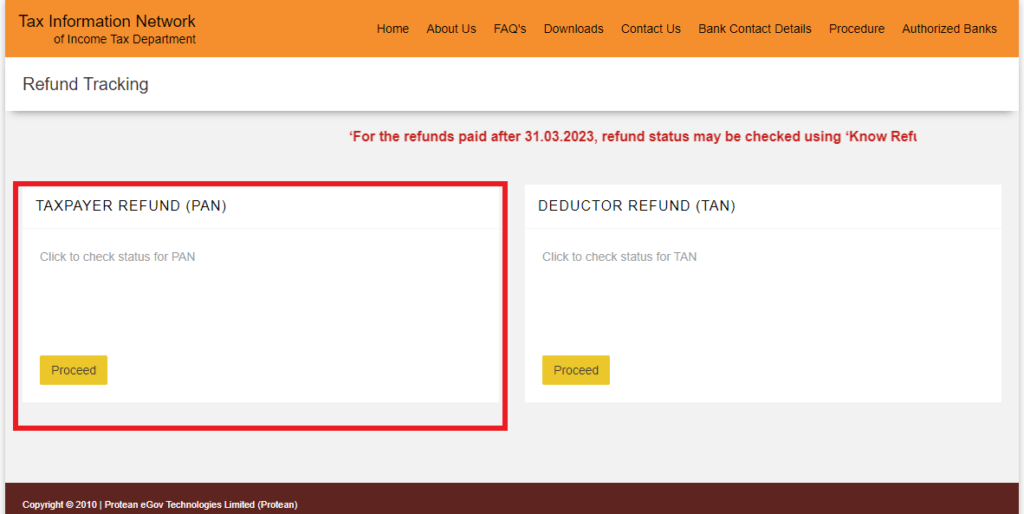

Step- 2: Once you are logged into your account, the first step is to enter your PAN, next choose the assessment year as 2024-25 and fill in the captcha code.

Step- 3: After filling all the details, click the “Submit” button. It will state the current income tax refund status.

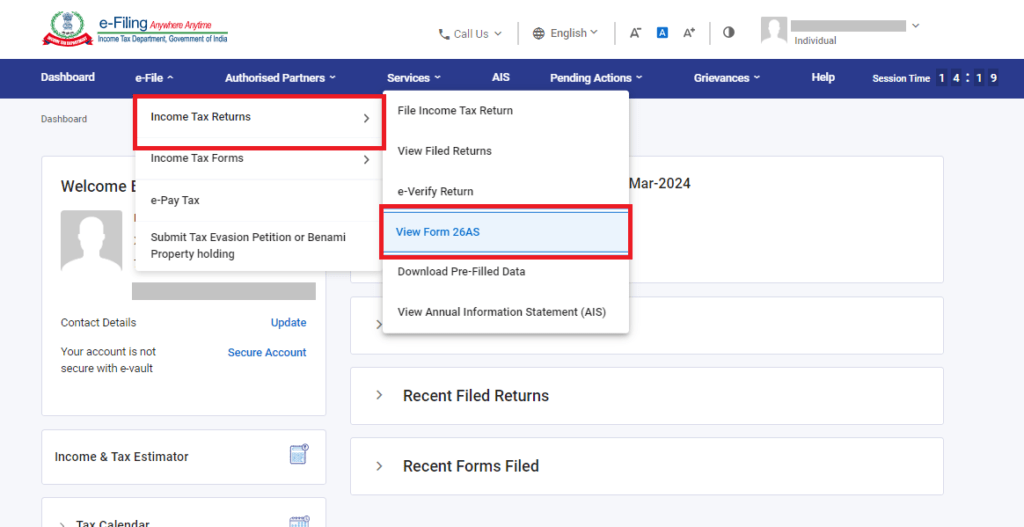

Step- 1: At first search the website www.incometax.gov.in

Step- 2: After login do click on e-file button on website, select income tax returns and navigate the View Form 26AS.

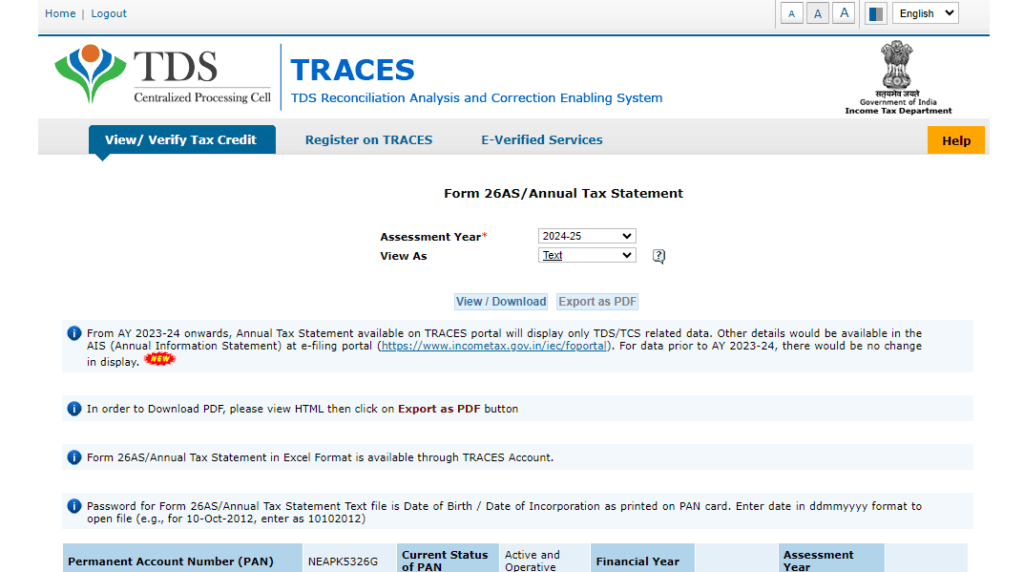

Step- 3: You will be directed to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page, Just Click on ‘View Tax Credit (Form 26AS/Annual tax statement) at the bottom of the page.

Step- 4: Select the Assessment Year from the drop-down menu, and select view as ‘text’.

If you are eligible for an income tax refund, follow these steps to claim it:

The process of submitting one’s Income Tax Return or commonly referred to as ITR.

Consolidate all the possible forms of income including, salary, interests, gains from other investments and so on.

Subtract the eligible deductions under sections such as 80C, 80D, and so on.

Subtracting the deductions, determine the income on which tax has to be paid.

Go to Income Tax e-Filing Portal and follow the links for filing of ITR selecting the right ITR form and assessment year.

Mobile number linked with your Aadhaar: Credited ITR for Aadhaar OTP; Net banking: ITR for Net Banking/EVC.

But, transmit the signed ITR-V (acknowledgment) to CPC, Bengaluru within 120 days from the day when the return is filed electronically.

The status of your return will be processed in the Centralized Processing Centre (CPC) to arrive at the amount of refund.

Later on, you will receive an intimation under section 143(1) of the refund which has to be claimed by the applicant.

The refund will be processed and this you will either receive it directly to your bank account or by a cheque.

Check if the ITR form contains the right account number of the bank account.

In case the refund was not processed, login back into the e-Filing portal and under the “Refund Reissue Request” link make the application for a reissue of the refund.

Therefore, following such steps will allow you to check out the status of our IT refunds and follow a proper process of getting the refund for the FY 2023-24 (AY 2024-25).

Let’s assume that for FY 2023-24, total income of Mr. Sharma was ₹ 10,00,000. He avails deductions under Section 80C for ₹1,50,000 and under Section 80D for ₹25,000. This is arrived at after the deductions in the taxable income formula which is arrived at by subtracting Rs. 1,75,000 from the gross income of Rs. 10,00,000 to arrive at a taxable income of Rs. 8,25,000. According to the tax slabs for FY 2023-24, his tax liability is calculated as follows: ₹ 2,50,000 is tax free, next ₹ 2,50,000 is taxed at 5% which is ₹ 12,500 and remaining ₹ 5,00,000 is taxed at 20% which is ₹ 1,00,000, making the total tax payble ₹ 1,12,500 only. Mr. Sharma received throughout the year ₹50,000 in terms of commission for which he has deposited ₹1,40,000 as TDS. Hence, the excess tax paid by Mr. Sharma is ₹ 27,500 as compared to the tax calculated by him @ ₹ 1,12,500. This excess amount, that is ₹ 27500/-, would be the income tax refund payable to Mr. Sharma.

Having filed his income tax return and affirming the details, Mr. Sharma sets the ball rolling in the refund process, and he will be able to have the excess tax paid to him, through his bank account.

What does my Income Tax Refund Status Mean?

The income tax refund status contains assorted messages that depict the progress of the refund when you check it. For example, if your status mentioning “Refund Paid,” then you will get the refund to your account or through cheque. Whether it reads “Refund Issued” this means that the refund has been processed and is on its way to arriving at your account. The meaning of “Refund Status Not Determined” is that the status of your refund is unknown or pending and this means that you need to come back later. If the status is St5-Refund Adjusted Against Outstanding Demand, then the amount for refund has been utilized to recover the amount of tax due, and the details are furnished in the notice. “No Demand No Refund” statement shows that no additional tax amount was paid and so no refund was to be made. “Refund Returned” is a status which is usually when there was a problem with the provided bank details or the cheques and you need to update the details and have the check resent. Lastly, the meaning of ‘ITR Processed’ is your return has been processed for refund, and it will be sent shortly. Knowledge of these statuses also enables you to be updated on the mode of your refund and any other actions that you need to undertake.

Is the Income Tax Refund Taxable?

No, the income tax refund itself is a non-taxable income or amount and you do not need to pay any taxes on the refund amount. The refund is basically the return of the extra taxes that a taxpayer has paid to the government during the Fiscal year either in the form of advance tax, TDS or the self-assessment tax. Since it is reimbursement of your own money, this is not regarded as income therefore you cannot be taxed.

Nevertheless, in the case of Income tax refund any interest earned on such refund is again taxable. Any interest you receive on the refund amount from the Income Tax Department is also considered as income and should be disclosed under the head ‘Income from Other Sources’ at the time of filing the income tax return of the year in which you actually received this interest. The interest is charged according to your appropriate income tax slab rate.

Time Duration for a Tax Refund

The time taken to receive an income tax refund depends with several factors such as the filed mode which is either online or offline, completion of filed return, error free filed return and the time taken by the Income Tax Department to process the filed return. Overall, it could range from as little as several weeks to as long as several months.

DISCLAIMER: The information provided in this article is intended for general informational purposes only and is based on the latest guidelines and regulations. While we strive to ensure the accuracy and completeness of the information, it may not reflect the most current legal or regulatory changes. Taxpayers are advised to consult with a qualified tax professional or you may contact to our tax advisor team through call +91-9871990777 or info@semantictaxgen.in

© 2013-25 Semantic Taxgen Pvt Ltd - All Rights Reserved